All Categories

Featured

Table of Contents

Trustees can be family members, relied on individuals, or financial institutions, depending on your preferences and the complexity of the trust fund. The goal is to make sure that the trust fund is well-funded to meet the kid's long-term financial needs.

The function of a in a youngster support count on can not be underrated. The trustee is the individual or company liable for handling the trust fund's possessions and ensuring that funds are dispersed according to the regards to the trust fund arrangement. This includes making certain that funds are used entirely for the child's advantage whether that's for education, treatment, or day-to-day costs.

They have to likewise offer normal reports to the court, the custodial parent, or both, depending on the terms of the count on. This liability ensures that the trust is being managed in a method that advantages the youngster, avoiding abuse of the funds. The trustee additionally has a fiduciary responsibility, implying they are legally bound to act in the most effective rate of interest of the kid.

By purchasing an annuity, moms and dads can ensure that a fixed amount is paid out consistently, no matter any kind of variations in their earnings. This offers satisfaction, understanding that the kid's requirements will remain to be fulfilled, despite the economic situations. Among the crucial benefits of using annuities for kid support is that they can bypass the probate procedure.

Who has the best customer service for Annuity Riders?

Annuities can also supply protection from market variations, making certain that the child's economic assistance continues to be stable also in volatile economic problems. Annuities for Child Assistance: An Organized Option When establishing up, it's necessary to think about the tax obligation implications for both the paying parent and the youngster. Trusts, relying on their framework, can have different tax treatments.

While annuities offer a secure earnings stream, it's crucial to comprehend how that income will be exhausted. Depending on the structure of the annuity, settlements to the custodial moms and dad or kid might be considered taxable earnings.

Among one of the most substantial benefits of using is the ability to protect a kid's financial future. Trusts, specifically, use a degree of defense from lenders and can make sure that funds are used responsibly. A trust fund can be structured to ensure that funds are only made use of for specific objectives, such as education and learning or healthcare, preventing abuse.

How do I get started with an Annuity Income?

No, a Texas kid assistance trust fund is particularly made to cover the youngster's necessary needs, such as education, medical care, and day-to-day living costs. The trustee is legally obligated to make sure that the funds are made use of exclusively for the benefit of the kid as described in the depend on contract. An annuity offers structured, foreseeable repayments with time, making sure constant financial backing for the youngster.

Yes, both kid assistance trusts and annuities come with possible tax obligation effects. Count on income might be taxed, and annuity repayments might additionally go through taxes, depending on their structure. It is very important to seek advice from a tax expert or monetary expert to understand the tax obligation responsibilities linked with these financial tools.

What types of Annuity Investment are available?

Download this PDF - View all Publications The elderly person population is large, growing, and by some price quotes, hold two-thirds of the individual wealth in the United States. By the year 2050, the number of elders is forecasted to be almost twice as large as it was in 2012. Because lots of seniors have actually had the ability to save up a savings for their retired life years, they are typically targeted with scams in such a way that more youthful people without savings are not.

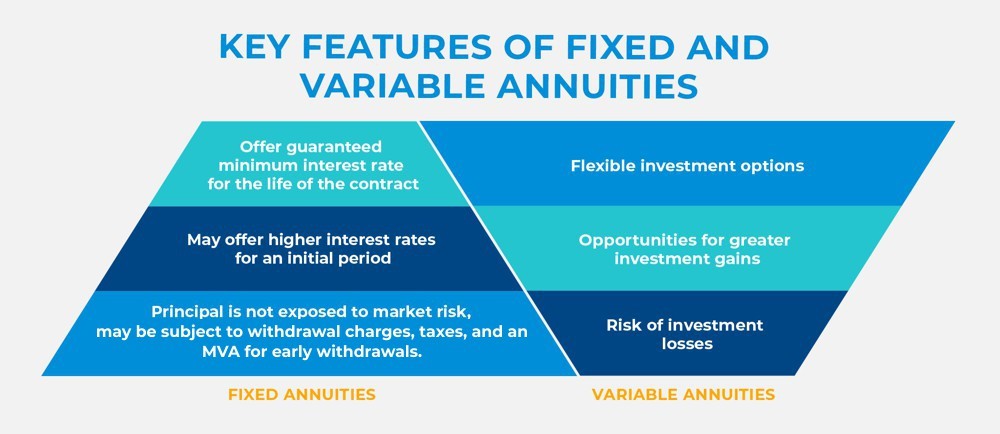

In this environment, consumers need to equip themselves with details to protect their interests. The Lawyer General supplies the adhering to ideas to consider before purchasing an annuity: Annuities are difficult investments. Some bear complicated top qualities of both insurance policy and safety and securities items. Annuities can be structured as variable annuities, taken care of annuities, instant annuities, deferred annuities, and so on.

Consumers need to review and recognize the syllabus, and the volatility of each investment listed in the syllabus. Investors ought to ask their broker to describe all terms in the program, and ask inquiries concerning anything they do not comprehend. Taken care of annuity products may also bring risks, such as long-lasting deferral periods, disallowing financiers from accessing every one of their cash.

The Chief law officer has submitted legal actions against insurance provider that offered improper deferred annuities with over 15 year deferment durations to financiers not expected to live that long, or who need access to their money for healthcare or assisted living costs (Annuity income). Financiers ought to make sure they know the long-lasting consequences of any kind of annuity acquisition

What types of Annuity Investment are available?

Be cautious of seminars that use complimentary dishes or presents. Ultimately, they are rarely free. Be cautious of representatives who give themselves phony titles to enhance their integrity. One of the most substantial charge linked with annuities is commonly the surrender charge. This is the portion that a customer is charged if she or he withdraws funds early.

Customers may desire to seek advice from a tax obligation professional prior to spending in an annuity. The "safety and security" of the financial investment depends on the annuity.

Representatives and insurance provider might provide bonus offers to attract capitalists, such as extra passion points on their return. The advantages of such "incentives" are usually surpassed by raised fees and administrative expenses to the capitalist. "Bonus offers" might be simply marketing tricks. Some deceitful agents motivate consumers to make unrealistic financial investments they can't pay for, or acquire a long-term deferred annuity, although they will require accessibility to their money for health and wellness care or living expenditures.

This area provides details useful to retirees and their family members. There are many occasions that may affect your advantages. Gives info regularly requested by brand-new retirees including transforming health and wellness and life insurance policy options, Sodas, annuity settlements, and taxable sections of annuity. Explains just how advantages are affected by events such as marriage, divorce, death of a partner, re-employment in Federal solution, or lack of ability to deal with one's finances.

What is an Annuity Investment?

Trick Takeaways The recipient of an annuity is an individual or company the annuity's owner designates to get the contract's death advantage. Various annuities pay to beneficiaries in different methods. Some annuities may pay the beneficiary stable repayments after the contract holder's fatality, while various other annuities might pay a survivor benefit as a lump amount.

Table of Contents

Latest Posts

Understanding Financial Strategies Key Insights on Variable Annuities Vs Fixed Annuities Breaking Down the Basics of Indexed Annuity Vs Fixed Annuity Advantages and Disadvantages of Variable Vs Fixed

Analyzing Variable Vs Fixed Annuities A Closer Look at Variable Annuities Vs Fixed Annuities Defining the Right Financial Strategy Advantages and Disadvantages of Different Retirement Plans Why Retire

Exploring the Basics of Retirement Options Everything You Need to Know About Financial Strategies What Is Tax Benefits Of Fixed Vs Variable Annuities? Features of Smart Investment Choices Why Fixed In

More

Latest Posts